OP Import Export Business Ideas for Sellers in India

Harsh Dhawan Export Experts Global OP Import Export Business Ideas for Sellers in India OP Import Export Business Ideas..

Harsh Dhawan

The considered export scheme’s goal is to extend the benefits and incentives experienced by exporters to suppliers that either indirectly contribute to exports (for example, a supplier who delivers items to an export-oriented unit) or who contribute to specific infrastructure projects. By offering duty-free inputs and incentives or exemptions on taxes or tariffs paid in India, the strategy tries to empower India’s domestic industry versus imports.

‘Deemed Exports’ are items (not services) manufactured in India and carried locally, i.e. they do not leave India, according to the Export and Import (EXIM) Policy (1997-2002). Deemed export simply indicates that the provider can be paid in either Indian Rupees or convertible foreign currency for this transaction.

‘Deemed Exports’ are items (not services) manufactured in India and carried locally, i.e. they do not leave India, according to the Export and Import (EXIM) Policy (1997-2002). Deemed export simply indicates that the provider can be paid in either Indian Rupees or convertible foreign currency for this transaction.

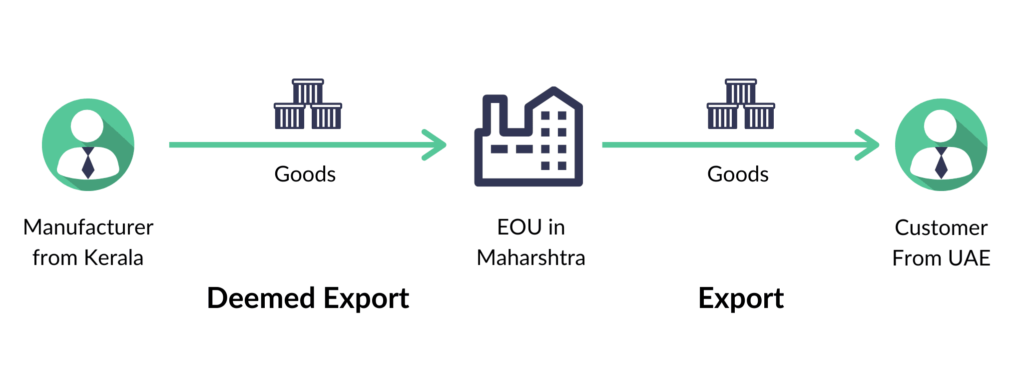

A commerce transaction in which items are manufactured locally and then shipped to a foreign country is known as an export. Goods designated as considered export are not allowed to leave the country.

For example, if a Kerala-based manufacturer supplies items to an Export-Oriented Unit in Maharashtra, which then ships the product to a customer in the United Arab Emirates, the first portion of the transaction is categorized as a deemed export, while the second half is classified as an export.

The following benefits are available to commodities that are eligible to be considered deemed exports:

The following benefits are available to commodities that are eligible to be considered deemed exports:

An Advance License for intermediate supply/deemed export/DFRC/DFRC for intermediate supplies/special imprest license is issued to the supplier.

The terminal excise duty is either exempted or entirely refundable for deemed exports.

A Special Import License is available to manufacturers at a fee of 6% of the Freight On Board (FOB) value.

The provider can benefit from the Deemed Export Drawback program, Refund of terminal excise duty, and Special Imprest License if the items were delivered under an Advance Release Order or Back to Back Letter of Credit.

All of the above benefits are available to suppliers that supply goods to an EPCG licensee, with the exception of the Special Imprest License and the Deemed Export Drawback Scheme. This is true if the supplies are made to a person who has a zero-duty EPCG license.

Under the GST, a transaction is deemed to be an export.

Under GST, exports, or items transported out of India, are zero-rated. This means that there is no GST rate applied to considered exports of commodities. However, deemed exports are not zero-rated, thus the items that qualify as deemed exports are subject to GST. This tax can be fully refunded to the supplier.

Harsh Dhawan Export Experts Global OP Import Export Business Ideas for Sellers in India OP Import Export Business Ideas..

Harsh Dhawan Export Experts Global Which is the Best Academy in India for Import-Export Training ? Which is the Best Academy..

Harsh Dhawan Export Experts Global What is Import Export Business? What is Import Export Business? Let’s break this down step-by-step..